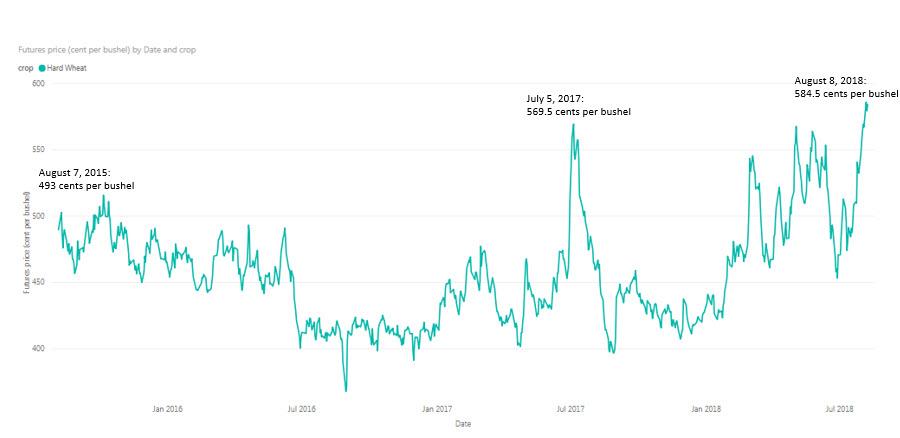

Early warning: Hard wheat prices continue to see excessive volatility

Hard wheat prices continued to experience excessive volatility this week, according to the Food Security Portal’s Excessive Food Price Variability Early Warning System . Futures prices for hard wheat on the Chicago Board of Trade rose in early August, reaching 586, 579, and 584 cents per bushel on August 6, 7, and 8, respectively; this is compared to 513 cents per bushel on July 6. According to the Wall Street Journal , Chicago wheat futures reached a three-year high in early August.

Hard wheat futures prices, 2015-2018

Source: Author’s calculations using Chicago exchange market. Note: All prices given are futures prices.

Severe hot weather and drought conditions in several major producing regions appear to be driving this spike in wheat prices. The European Union, the Black Sea Region, and Australia are all experiencing significantly dry conditions that have stunted wheat growth and reduced production prospects. The International Grains Council recently reduced its 2018-2019 wheat production forecasts for the EU from 148.3 million tons to just over 140 million tons.

The market has also been reacting to concerns over possible wheat export limitations from the Ukraine and Russia . Such a policy could further impact global wheat supplies, and the announcement of the possible limits in early August resulted in volatility in the wheat market. The Ukrainian Agricultural Ministry later soothed markets somewhat by clarifying that it is not discussing strict limits. Russia similarly clarified its intention of discussing export volumes, not exports altogether. The ongoing trade war between the United States and China is also impacting global commodities markets, with pressure on soybean and indirectly on other staple commodities.

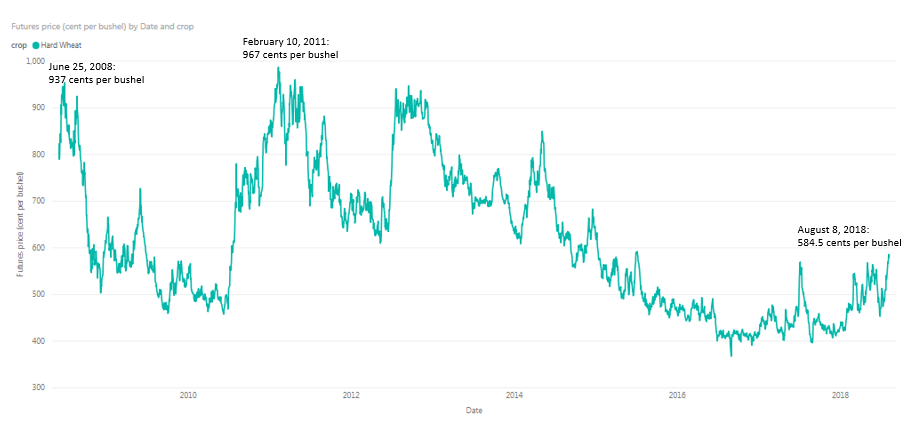

Despite the recent increase, wheat prices remain significantly below the levels seen during the 2007-2008 and 2011 food price crises. For example, in 2008, Chicago future prices reached about $10 per bushel for wheat. In addition, production prospects are not alarming everywhere. According to the latest GEOGLAM crop monitor , conditions for winter wheat and spring wheat in the United States are favorable, with the exception of the southern Great Plains. Canada is experiencing similarly favorable conditions for both spring and winter wheat in the northern parts of the country. The production situation is also favorable in China and Kazakhstan, and spring wheat conditions are favorable in the Russian Federation. Exports from these regions, particularly the US and Canada, stand to grow considerably to make up the shortfall in other producing areas.

Hard wheat futures prices, 2008-2018

Source: Author’s calculations using Chicago exchange market. Note: All prices given are futures prices.

By: Sara Gustafson, IFPRI

Files: