Déjà vu all over again: Global sugar markets roiled by El Niño, biofuels and trade policies

Related blog posts

As with other commodity markets such as rice, the global sugar market has seen large increases in prices due to El Niño-related production shortfalls in major exporting countries in South and Southeast Asia. At the same time, other factors are also constricting supplies. Port bottlenecks have tied up exports in Brazil, the world's largest sugar exporter, despite a large increase in production over last year's levels. Domestic biofuel policies in key exporting countries are diverting sugar production to biofuel production and thus limiting exports. rice markets, export restrictions—here, in India and Thailand—have exacerbated these shortages as well.

These supply constraints have pushed global sugar prices in recent weeks to the highest level since September 2011 (Figure 1). In this post, we explore these factors and their potential impacts on supplies and consumption.

Figure 1

El Niño affects sugar output in India and Thailand; production rebounds in Brazil

The cyclical Pacific climate pattern El Niño has brought dryness to key sugar-producing areas in South and Southeast Asia, and will likely adversely affect exports from India and Thailand, the two largest global exporters of sugar after Brazil. India’s sugar output for 2023/24 could drop to 33.7 million metric tons (MT) from the 36.6 million MT estimated for 2022/23, according to the Indian Sugar Mills Association (ISMA). This forecast is down about 7% from August forecasts.

In Thailand, drought has reduced sweetener production to an estimated 7 million-8 million MT in 2023-24, down from 11 million MT crushed in the previous crop, according to the Thai Sugar Millers Corp. Exports could fall to 4 million-5 million MT next year, a decline of 30%-40% from the 7 million MT expected in 2022/2023.

By contrast, Brazil's production prospects are anticipated to improve this year to 42.7 million MT, up 15% from last year. More mills have shifted production from ethanol to raw sugar, although recent increases in energy prices could shift this balance in the other direction later this year (see below). But despite improved production prospects, sugar exports have been hampered in recent months by port congestion due to large soybean and maize (corn) crops.

Overall, then, global sugar stocks have been tightening and will likely shrink further if production impacts from El Niño worsen (Figure 2), putting continued upward pressure on prices.

Figure 2

Sugar consumption and trade

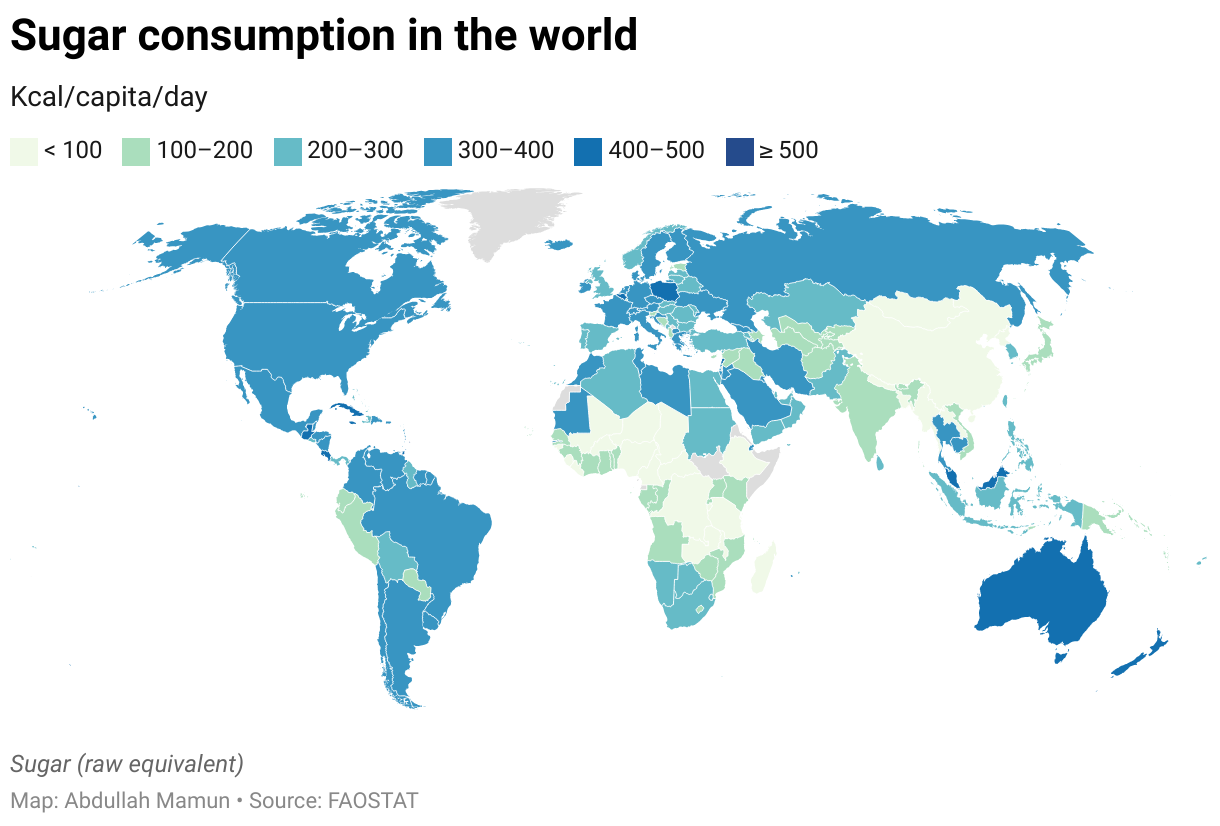

High global sugar prices can have a mix of impacts—some harmful, others, in terms of diets and public health, potentially beneficial. In a number of low-income countries, sugar is dietary staple. Yet in many countries across a range of income levels, high sugar consumption is associated with higher rates of obesity and a number of non-communicable diseases, including diabetes. World Health Organization dietary guidelines suggest limiting sugar consumption to 5%-10% of total energy intake—or less—based on a 2000-kilocalorie diet, or 100-200 kcal.

Sugar consumption is high in most developed and upper middle-income countries except China (Figure 3). As many as 66 countries have an average per capita intake of over 300 kilocalories per day, including many in the Middle East and North Africa (MENA) region, South and North America, and Europe. While consumption in Southeast Asia is generally low, some countries including Cambodia, Malaysia, and Thailand, consume large amounts of sugar per day. Thus persistently higher sugar prices may reduce consumption in these countries and have potentially positive public health impacts.

Low sugar consumption is found in sub-Saharan Africa and Asia. In Africa, notable low sugar consuming countries include the Democratic Republic of Congo (DRC), Myanmar, Burundi, Guinea Bissau, with less than a 50 kcal intake of sugar per day per person. Obesity rates are generally quite low in these countries—but sugar is also an important contribution to overall household diets.

Figure 3

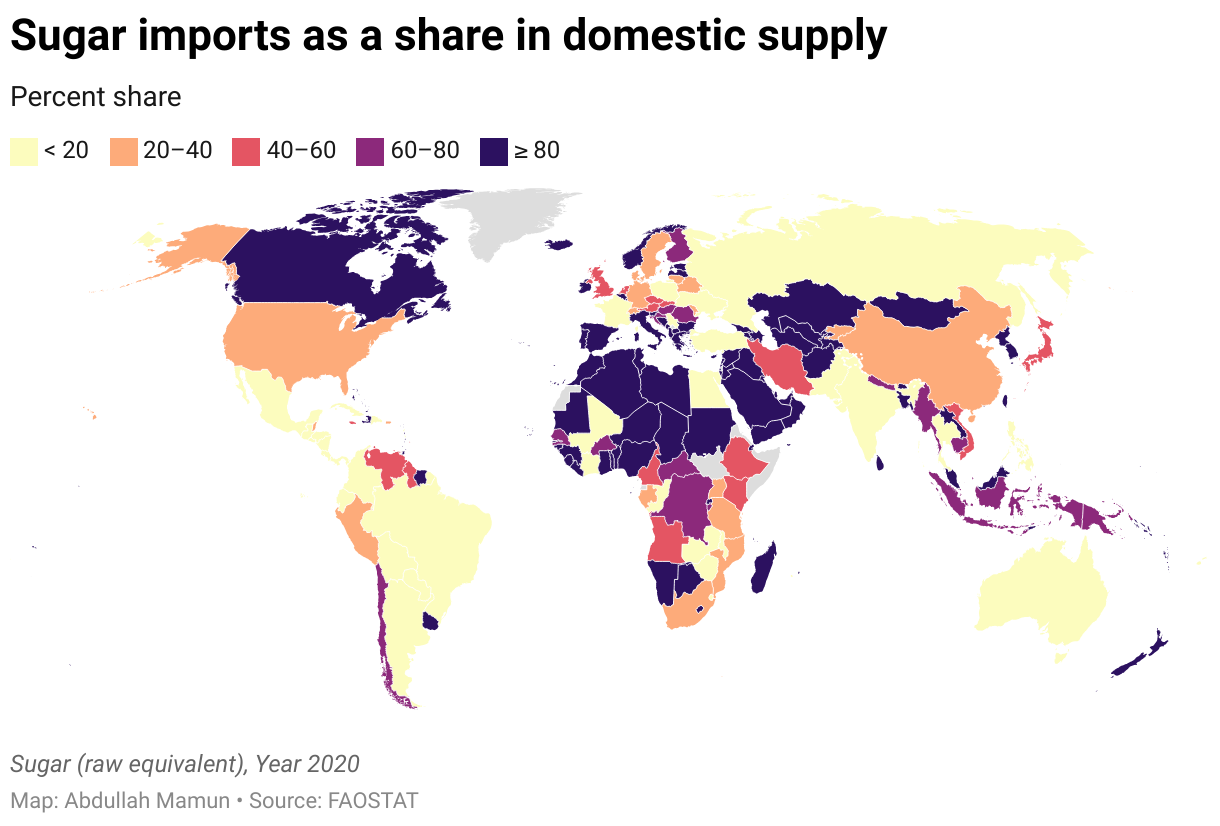

Globally, imports account for roughly one third of total sugar consumption. As many as 73 countries have virtually no domestic production and are fully dependent on sugar imports—here impacts will vary by country. High import dependency is mostly concentrated in Central Asia, MENA, and sub-Saharan Africa. Export restrictions on sugar will hit most of the low-income countries in sub-Saharan Africa—which import 60%-100% of their sugar supplies—including the DRC, Sudan, Namibia, Madagascar, Sierra Leone, Niger, Cote d’Ivoire, and Liberia. A number of countries in South Asia, including Bangladesh, Sri Lanka, and Nepal, are also largely import dependent, with India the principal or only source.

Figure 4

Biofuels

Rising demand for alternative energy sources, as well as shifting global energy markets, have led countries to boost ethanol production—and, as a result, lower sugar production. According to the OECD, globally about 23% of ethanol is produced from sugarcane and 7% from molasses (a by-product from processing sugarcane or sugarbeets into sugar) (Figure 5). Recent shifts in biofuel policies have spurred ethanol production in many sugar-producing countries. For example, India's current average blend rate for ethanol is 11.5%. India has announced that it aims to nearly double that by 2025, reaching a blend rate of E20 (20%). About 20% of India’s sugarcane production goes to ethanol, and barring a large expansion of sugarcane plantings, that percentage will likely increase significantly as the target rate rises.

Brazil biofuel policies, which stress flexibility between biofuel and sugar production, date back to the early 1930s. Brazil has a large fleet of flex-fuel vehicles that can run either a mix of gasoline and anhydrous ethanol (called gasoline C) or pure hydrous ethanol (E100). The blending rates for gasoline C are set annually and range between 18% and 27% depending on the relative price relationship between domestic sugar and ethanol. The blend rate for gasoline C is currently legislated at 27%. The government is considering raising the mandate to 30%. The overall blend rate for gasoline C and pure hydrous ethanol is 47.5%. Over 400 million MT of sugarcane went to Brazil ethanol production in 2023, or 51% of total sugarcane production.

Figure 5

Thailand also maintains an ethanol program with molasses, sugarcane, and cassava as the primary feedstocks. An estimated 3.3 million MT of molasses and 775,000 MT of sugarcane were used in ethanol production in 2023.

Export restrictions

With global sugar prices rising and supply issues due to El Niño, both India and Thailand have moved to restrict sugar exports. The two countries currently account for about one third of total sugar exports, up from 19% in 2016, and with most of the growth due to India (Figure 6).

Figure 6

In June 2022, India limited exports on all types of sugar including raw sugar, white sugar, and refined sugar (Table 1). Data suggests that sugar exports over the 2022/23 marketing year were down almost 30% from year earlier. Because of high food inflation and the poor production outlook for the 2023/24 season, the government recently extended the curb on exports beyond its original October 31 end date—likely for the foreseeable future.

Table 1

In an October 28 government decision, Thailand listed sugar as a controlled commodity for one year, a move aimed at ensuring domestic supplies of the sweetener and keeping inflation in check. Like other controlled goods, this means that any retail price changes or exports of 1 MT or more must first be cleared by a regulating panel. This will add costs and could lead to delays in fulfilling delivery contracts for sugar already sold on the futures market.

Implications

Recent developments in the global sugar market track the experience of other agricultural markets over the past two years. Supply shortfalls have driven prices to the highest levels in year. Prices are exacerbated by domestic policies, in this case biofuel policies that divert production to non-food uses, and export policies that aim to insulate domestic markets, only to "export" that volatility to the rest of the world.

Should we be concerned with higher sugar prices? In theory, higher prices should reduce demand for sugar and sugar-containing products, which is arguably a good outcome considering the health problems associated with high sugar consumption. However, in many countries where obesity rates are high, so too, are incomes, which may moderate those impacts. Moreover, many high-income countries already insulate their domestic sugar markets from global price fluctuations through high tariffs (for example, the United States).

Of far greater concern is the impact of higher sugar prices on food security in the least developed countries, particularly in sub-Saharan Africa, where many depend entirely on imports to fulfill their needs. Those countries will face larger food costs, thus increasing the burden on the poorest households, which spend a disproportionate share of their income on food.

Joseph Glauber is a Senior Research Fellow with IFPRI's Markets, Trade, and Institutions (MTI) Unit; Abdullah Mamun is an MTI Senior Research Analyst. Opinions are the authors'. (Headline phrase attributable to Yogi Berra.)