Russia’s Renewed Attacks on Ukraine’s Grain Infrastructure: Why Now? What Next?

Russia’s recent attacks on Greater Odesa port infrastructure and grain-carrying vessels in the Black Sea marked the most intense attacks on Ukraine’s agricultural infrastructure in over a year. In September, according to the United Nations, Russian attacks damaged grain infrastructure and six civilian vessels in Ukraine’s Black Sea ports. Russian ballistic missiles then struck foreign-flagged ships on October 6, October 7, October 9, and October 14, also damaging a grain warehouse and other port infrastructure with the October 14 strike. Four of the ships hit in October were carrying agricultural commodities, including vegetable oil for the UN World Food Programme (WFP) in Gaza, as well as corn and grain shipments for Egypt, Italy, and Southern Africa, according to statements by the Ukrainian and UK governments.

Q1: What was the nature of Russia’s recent attacks on Ukraine’s grain export infrastructure?

A1: As of October 11, the UN Human Rights Monitoring Mission in Ukraine reported that the October attacks had killed 14 civilians and injured 28, though the ultimate goal of the attacks was likely to further diminish Ukraine’s agricultural export capabilities. According to Ukrainian deputy prime minister Oleksiy Kuleba, “The purpose of these attacks is to reduce our export potential. It is about deliberately provoking a food crisis in those parts of the world that directly depend on the supply of Ukrainian grain.” A September 12 strike on a cargo ship carrying Ukrainian grain to Egypt marked the “first time a missile ha[d] struck a civilian vessel transporting grains at sea”—in this instance, in the economic waters of NATO member Romania—since Russia launched its full-scale invasion of Ukraine in February 2022, according to Reuters. In total, since February 2022, Russia has made 50 attacks against Ukraine’s Black Sea ports, damaging more than 300 port infrastructure facilities and 23 civilian vessels and destroying more than 100,000 metric tons of agricultural products, according to Ukrainian foreign minister Andrii Sybiha.

As widely reported by CSIS and others, Ukraine’s agriculture sector has been a major front in Russia’s war in Ukraine since February 2022. With the September and October 2024 attacks, Russia continues its system-wide attacks on Ukraine’s agriculture infrastructure, negatively affecting Ukraine’s agricultural production and exports and thereby undercutting a major source of Ukraine’s export revenue. Ukraine’s Ministry of Agrarian Policy and Food estimates damages from the October 2024 attacks at up to $40 million. Total war-related damages to Ukraine’s agriculture sector are estimated at $10.3 billion from February 2022 through January 2024, according to a 2024 assessment by the Kyiv School of Economics (KSE) and partners, while total war-related losses to Ukraine’s agriculture sector are estimated at $83 billion, according to a subsequent assessment by KSE and partners.

Q2: What is the status of Ukraine’s and Russia’s agricultural exports?

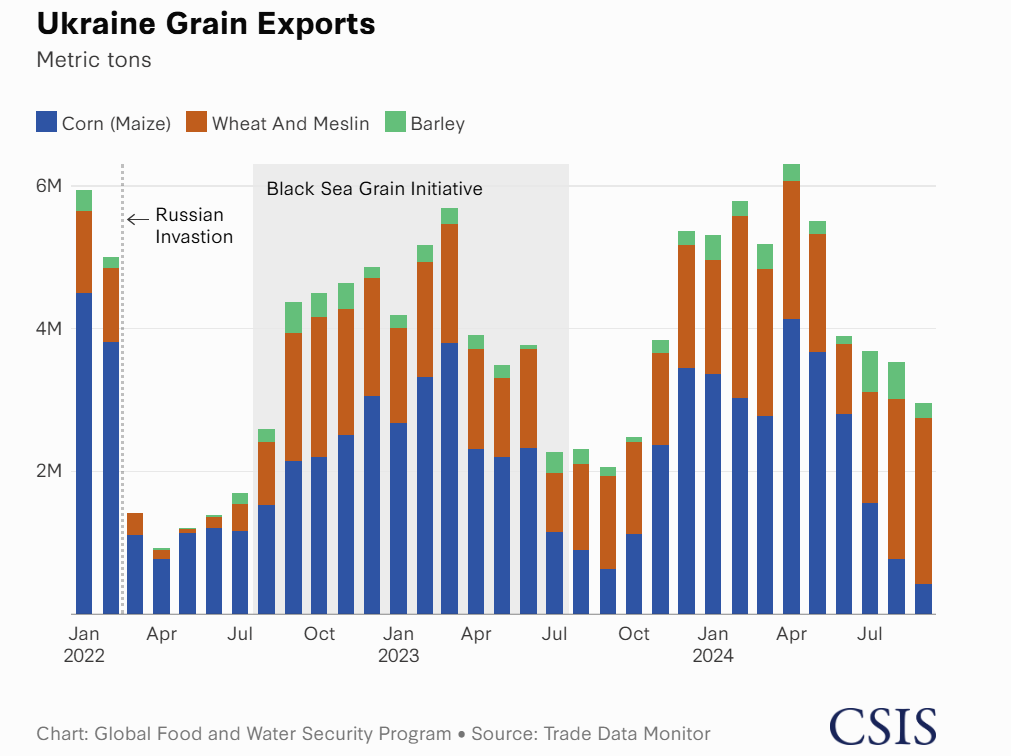

A2: Russia’s recent attacks on Ukraine’s agricultural export infrastructure and cargo ships carrying Ukrainian grain affect the ongoing and upcoming export of Ukraine’s major agricultural commodities, including barley, rapeseed (canola), and wheat crops, which are harvested in the summer and exported in the fall, and maize (corn) and sunflower crops, which are harvested in the fall and exported in late fall and winter.

Despite Ukraine’s laudable success in producing and exporting grains during wartime, the aggregate impact of Russia’s war has been to reduce Ukraine’s production and export capacity. Ukraine is estimated to export almost 2.6 million metric tons (MMT) less wheat in the 2024/25 season than in 2023/24, a reduction of 14 percent. Ukraine’s maize (corn) exports are estimated to fall by 6.6 MMT, a decline of 23 percent, in the same period. Ukraine saw higher-than-expected exports of wheat and maize in 2023, which some incorrectly interpreted as indicating a recovery of Ukraine’s agriculture sector from the impacts of Russia’s war. In fact, 2023/24 exports included not only grains harvested that year but also grains that had been held in Ukraine’s ports since the onset of the war. Further, favorable weather conditions in 2023 drove higher average yields and harvests, enabling Ukraine to surpass production expectations despite wartime conditions. With the full export of these previously stored grains, the United States Department of Agriculture has predicted Ukraine’s 2024/25 exports will be at the lowest level in over a decade.

In February 2024, CSIS analyzed the impacts of the Russia–Ukraine war on Ukraine’s and Russia’s export levels and trade relationships, finding that since February 2022, Ukraine’s grain exports had fallen relative to prewar exports for every region except Europe. (With limited access to its Black Sea ports, Ukraine was forced to export much of its grains through its European neighbors and thus increased exports to some European countries.) According to Trade Data Monitor, Ukraine’s latest wheat exports follow a similar pattern: in the calendar year 2021, Ukraine exported about 11 percent of its wheat to sub-Saharan Africa. In 2022, Ukraine exported less than 6 percent of its wheat to the region. In 2023, that percentage had dropped to 2.5, and from January to August 2024, wheat exports to sub-Saharan Africa were less than 1 percent of Ukraine’s total wheat exports.

As the world’s largest wheat exporter, Russia produces and ships significantly more wheat than Ukraine. In the 2023/24 season, USDA estimates that Russia exported record volumes of wheat totaling 55.5 MMT, an increase of 6.5 MMT, or 13 percent, over the previous year despite frost conditions diminishing winter crop harvests. Of particular issue is how much of the increase in Russian exports reflects High ending stocks from previous seasons’ harvests were supplemented by stolen Ukrainian grain and wheat harvested on Ukrainian territory under Russian occupation. The Ministry of Agrarian Policy and Food of Ukraine estimates that Russia has exported roughly 4 million tons of agricultural produce from occupied territories valued at $800 million since the full-scale invasion began. Drought in Russia’s grain-producing regions in 2024 is expected to reduce Russia’s 2025 wheat harvest, predicted at 7.5 MMT lower in 2024/25 than in 2023/24. Russia’s wheat exports through the first four months of the 2024–2025 July-June marketing year are estimated at 14.7 MMT, down 5.5 percent from 13.9 MMT over the same period last year. Overall, Russia’s wheat exports for the entire 2024/25 marketing year are forecast to be down 14 percent to 48 MMT.

Q3: What is the impact of Russia’s and Ukraine’s reduced food exports on global agriculture markets?

A3: Reduced exports from Russia and Ukraine will likely continue to put upward pressure on global grain prices. Global food prices reached all-time nominal highs in March 2022 following Russia’s invasion of Ukraine. Prices declined markedly following the implementation of the Black Sea Grain Initiative (BSGI), which facilitated exports of Ukrainian grain from mid-2022 through mid-2023 and continued to decline following the cessation of the BSGI, with Ukraine’s continued export of grains as well as exports from other major exporting countries. World food prices began to increase again in 2024—supplies were constricted due to inclement weather and trade policies, including export restrictions in some countries—and from August to September 2024, saw their largest month-on-month increase since March 2022. World food prices increased further in October 2024. As global food prices increase, food-price inflation remains high at the national level, particularly in low- and lower-middle-income countries. According to the World Bank, food-price inflation for the period November 2023–October 2024 was higher than 10 percent in 21 low- and lower-middle-income countries; in 6 of these countries, food-price inflation was higher than 30 percent. Food price inflation remains high in some high-income countries as well. In the United States, though food prices have declined from record highs in 2022 (due, in part, to price shocks related to Russia’s invasion), prices remain twenty percent above pre-pandemic levels.

Decreased exports from Ukraine and Russia are contributing to higher global food prices, including higher prices for wheat and maize. Russia’s attacks on Ukraine’s export infrastructure and cargo ships affect markets further: According to Bloomberg, wheat futures jumped 2.2 percent in response to Russia’s first attack on a commercial vessel in September 2024, while the UN Food and Agriculture Organization cites renewed tensions in the Black Sea as a factor in rising global cereal prices.

Q4: Russia’s renewed attacks—why now?

A4: Russia’s September 12 attack on a civilian vessel carrying Ukrainian grain to Egypt coincided with NATO deliberations over Ukraine’s deep strikes into Russian territory; unique Russian attacks such as these may have been retaliatory in nature.

Overall, timed at the outset of Ukraine’s major agricultural export season, Russia’s recent attacks on Ukraine’s agricultural infrastructure and grain-carrying ships are likely intended to reduce the export of Ukraine’s 2024 harvest to Ukraine’s trading partners, thereby reducing export revenue to Ukraine and undercutting its trade relationships. Expectations following the cessation of the BSGI were that Ukraine’s maritime agricultural exports would plummet; the BSGI had guaranteed the safe passage of ships into and out of Ukraine’s Greater Odesa ports, while on the termination of the BSGI, Russia again declared the Black Sea to be unsafe for transit. But following the end of the BSGI, Ukraine was able to maintain sizeable exports from its Black Sea ports via the Ukrainian Corridor, a route passing from Ukraine’s western Black Sea waters and through the territorial waters of NATO members Romania, Bulgaria, and Turkey. According to Ukraine’s Minister of Foreign Affairs, since the route was established in August 2023, more than 2,800 vessels have entered Ukrainian ports, exporting more than 51 MMT of agricultural exports to food-importing countries. These totals far surpass Ukraine’s exports under the UN-brokered BSGI, under which just over 1,000 vessels had entered Ukrainian ports, exporting nearly 33 MMT of Ukrainian agricultural commodities.

Furthermore, in the year-plus since the cessation of the BSGI, Ukraine has actively courted agricultural partnerships with numerous food-exporting and -importing countries. These include a July 2024 agreement with the United Kingdom and Lithuania to develop a system to identify stolen Ukrainian grain sold by Russia on the world market; a cooperative agreement on agriculture and food with India, signed by President Zelensky and Prime Minister Modi in August 2024; and discussions with European Union member states, including France, Denmark, Hungary, and others over strengthened cooperation and the Ukraine’s implementation of EU agriculture standards. In October 2024, Ukraine held its Ukraine-Africa forum with representatives of 21 African countries to expand agricultural cooperation and trade on the continent. By 2024, Ukraine had supplied over 17,000 metric tons of wheat to Ethiopia, Somalia, Yemen, Nigeria, Sudan, and Kenya via the UN WFP under the Grain From Ukraine initiative launched in 2022, which intends to use Ukrainian grains to address acute food insecurity in countries experiencing humanitarian crises.

A major goal of Russia in its widespread attacks on Ukraine’s agricultural infrastructure has been to reduce the reliance of food-importing countries on Ukrainian grains and oilseeds, which opens opportunities for Russia to expand agricultural trade—and influence—in these countries, many of which have been made more food-insecure by Russia’s war in Ukraine. For example, since Russia invaded Ukraine, Russia’s wheat exports to sub-Saharan Africa have surged: from July through October 2023, Russia exported 1.9 MMT of wheat to sub-Saharan Africa, accounting for 13 percent of Russia’s total wheat exports, according to the Trade Data Monitor. From July through October of 2024, Russia exported 2.7 MMT of wheat to sub-Saharan Africa, accounting for 20 percent of its total wheat exports and marking a 39 percent increase in its exports to the region year on year. Russia has also delivered free grains to countries friendly to Russia, including Burkina Faso, Eritrea, Mali, Zimbabwe, Somalia, and the Central African Republic.

Russia likely interprets Ukraine’s impressive food trade and vigorous efforts to form agricultural partnerships—notwithstanding its overall reduction in agricultural exports—as threats to the influence that Russia wields through its own agricultural exports. Maintaining this influence in global agricultural markets is not only a geopolitical imperative for Russia but underpins the economic goals Putin has put forward for the next two presidential terms: in May 2024, Russian state media outlet RT reported that Putin has issued a goal for Russia to have the fourth-highest GDP in the world by 2030, an effort involving a shift in exports “away from energy products, with agriculture considered a significant driver of future foreign trade.”

Though many, like Ukrainian deputy prime minister Kuleba, decry Russia’s recent attacks for the impact they will have on global agriculture markets and global food security, Russia likely views the circumstances differently. It likely notes that global food insecurity can create openings for Russia to expand its influence and its agricultural trade with food-insecure countries, particularly as they may experience Ukraine’s exports as unreliable, given the unpredictability of Russia’s attacks. Russia likely sees Ukraine’s recent agriculture-trade successes as competing with its own agricultural influence; the projection of diminished Russian wheat exports in 2025 could make Ukraine’s successes more threatening.

Q5: What is needed to rebuild Ukraine’s agriculture sector? How are allied governments supporting Ukraine’s agriculture sector?

A5: Numerous allied governments, including the United States, are providing robust support for Ukraine’s agriculture sector. In October, the United States Agency for International Development (USAID) announced that it had leveraged more than $2.26 billion in investments from the private sector and other partners under the Agriculture Resilience Initiative-Ukraine (AGRI-Ukraine) initiative, launched in July 2022. USAID has committed $350 million to Ukraine’s agriculture sector under the initiative and has also launched USAID Harvest, a project aimed at strengthening Ukraine’s grain and oilseed sector through market system efficiency. Other allied governments and international organizations, including Japan and Canada and the UN International Fund for Agricultural Development, of which Ukraine became the most recent member in October 2024, are pledging support for various aspects of Ukraine’s agricultural recovery.

Following Russia’s October attacks, UK prime minister Kier Starmer revealed that British intelligence had detected a “noticeable increase in Russian risk appetite,” potentially portending additional Russian attacks on Black Sea port infrastructure and cargo vessels in the region. The United Kingdom and Norway are presently leading efforts to protect the Ukrainian corridor, while Deputy Prime Minister Kuleba has stated that the Ukrainian government is strengthening defense measures in every Black Sea port. Ukraine has also called on the International Maritime Organization to send an international monitoring mission to the Greater Odessa ports. Relatedly, for ships transiting the Black Sea, the cost of war insurance has surged since Russia’s October attacks; the provision of wartime insurance has been central to Ukraine’s maritime export successes.

Given Russia’s recent attacks and its probable perception of benefits from further attacks, more attacks on Ukraine’s agriculture export infrastructure and cargo ships could be expected. Ukraine’s continued agricultural exports are critical to its own economy, to global agriculture markets, to Ukraine’s trade relationships, and to countering the influence Russia wields through its agricultural exports. Supporting Ukraine’s agriculture sector requires not only on-farm investments such as those provided by USAID and its partners but also increased defense of Ukraine’s ports and affordable insurance for ships entering and exiting them. The United States and allied governments could consider funding these purposes through G7 Extraordinary Revenue Acceleration loans to Ukraine and other funding vehicles.

Caitlin Welsh is the director of the Global Food and Water Security Program at the Center of Strategic and International Studies (CSIS) in Washington, D.C. Joseph Glauber is a senior adviser (non-resident) with the Global Food and Water Security Program at CSIS. Emma Dodd is a research associate with the Global Food and Water Security Program at CSIS.

The authors would like to thank Antonina Broyaka and Vitalii Dankevych, senior associates (non-resident) with the CSIS Global Food and Water Security Program, for their contributions to this analysis.